tn franchise and excise tax mailing address

Tennessee Department of Revenue. All franchise and excise returns and associated payments must be submitted electronically.

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents.

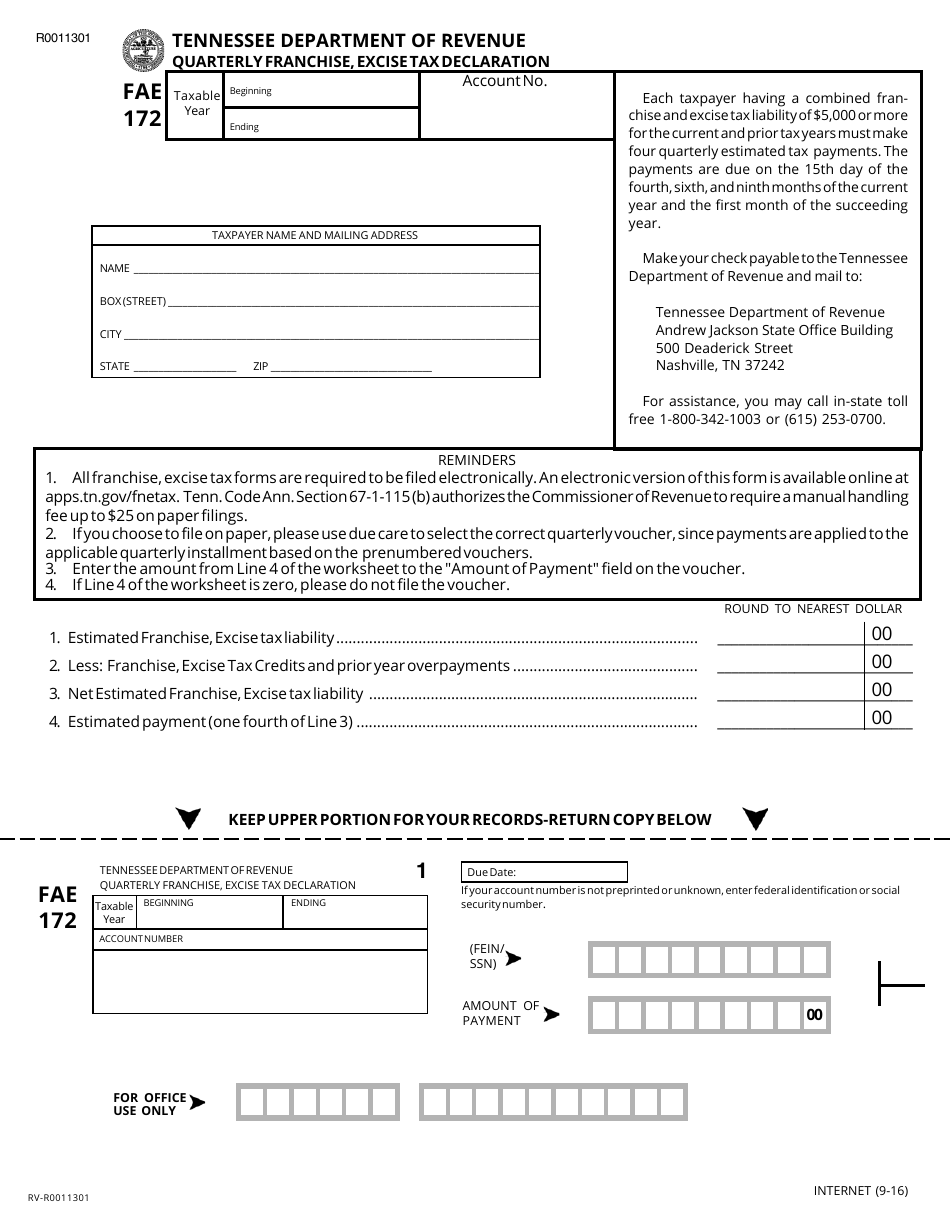

. Franchise Excise Tax Forms Online Filing - All franchise excise tax returns must be filed and paid electronically. Please visit the File and Pay section of our website for more information on this process. TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence.

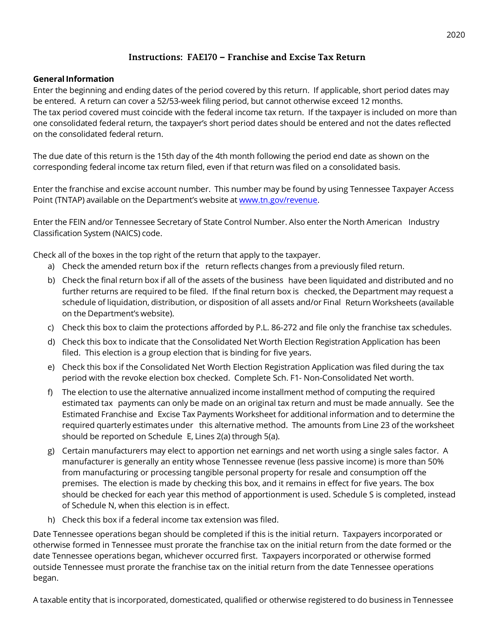

All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. Franchise Excise Tax - Excise Tax Follow Franchise Excise Tax - Excise Tax All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year. 615 253-0700 1-800-342-1003 ln State Toll-Free E-mail.

Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Tennessee Department of Revenue Attention. Mailing Address Street City State ZIP Code.

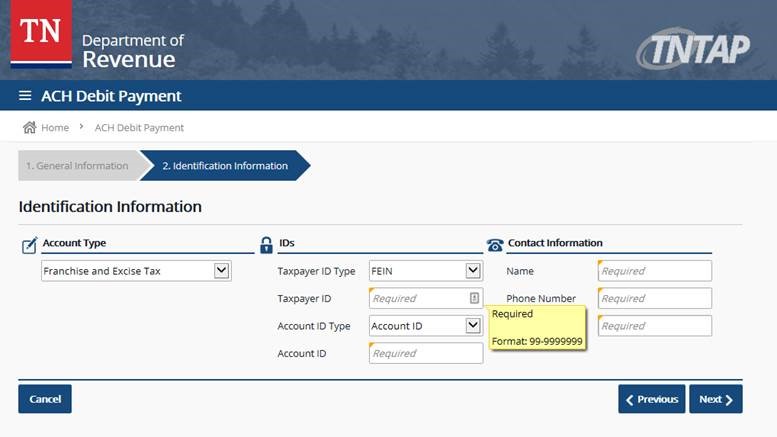

You may also send an email to tnentertainmenttngov or call 615 741-3456. Input the Contacts name phone number and email address. FONCE-2 - Relationships That are Considered Family Members for the FONCE Exemption.

If calling from Nashville or outside Tennessee you may call 615 253-0700. The number is 800 397-8395. Name of Contact Person.

The excise tax is based on net earnings or income for the tax year. The tax is based on the entitys net-worth or the book value of all real estate and taxed at the rate of 25 cents per 100 and annual minimum tax of. For Account Type choose Franchise Excise Tax.

500 Deaderick Street Nashville Tennessee 37242 Phone. What is TN form Fae 170. Tennessee Department of Revenue PO.

The Department of Revenue also offers a telecommunications device for the deaf TDD line at 615 741-7398. Where do I mail my TN franchise and excise tax return. Franchise Excise Tax Return Mailing Address Tennessee.

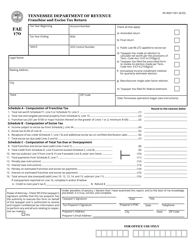

Tennessee Department of Revenue 500 Deaderick Street Nashville TN 37242. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn. Where do I mail my TN franchise and excise tax return.

Please mail completed applications and annual renewals to. The minimum tax is 100. What is TN form Fae 170.

For questions or assistance with this form please call 615 253-0700 Monday through Friday 830 am-430 pm. Where do I mail my TN franchise and excise tax return. Andrew Jackson State Office Building.

Qualified Production Activity for Franchise and Excise Tax Credit The Tennessee Film Entertainment and Music Commission has been provided information describing the basis for. 123456789 New account format. Electronic Filing and Payment.

FONCE-3 - Entity Types That May Qualify for the FONCE Exemption. Fill in payment details. Tennessee Department of Revenue.

Please view the topics below for more information. TENNESSEE FRANCHISE AND EXCISE TAX Telephone. If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero to the beginning of the number.

FONCE-1 - Qualification and Filing Requirements for the Family Owned Non-Corporate Entity FONCE Exemption. 8 rows Franchise Excise Tax Practitioner Hot Line. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

Fill in the Taxpayer ID Type ID and Account ID. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn. Box 190644 Nashville TN 37219-0644 For tax assistance call 800 397-8395 in Tennessee or if you are located in the Nashville call area or out-of- state call 615 253-0700.

Tennessee Department of Revenue Franchise and Excise Tax Application for Exemption Department of Revenue Form RV-F1319201. Choose the Period this should be the filing period end date you want the estimated payment to be credited towards. Essentially the Tennessee LLC is subject to a franchise and excise tax for the privilege of doing business in their state.

Andrew Jackson State Office Building. This has to be filed with the Tennessee. FONCE-4 - The FONCE Exemption When No Income Was Generated.

Nt of Revenue. Form FAE 170 is created for small business owners to report franchise and excise tax and income to the Department of Revenue. If you have questions about Franchise And Excise Tax Online contact.

Amended Return Mailing Address. 4 rows Business Mailing Addresses. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business in Tennessee regardless.

Qualified Production Franchise Excise Tax Credit A franchise and excise tax credit is available for tax years beginning on or after July 1 2021 for qualified payroll expenses incurred by taxpayers engaging in qualified productions in Tennessee. This form in particular is designed for entrepreneurs in the State of Tennessee. Andrew Jackson State Office Building.

931 455-9301 Street Address. CST or visit wwwtngovrevenue for more detailed information. What Credit Cards are accepted.

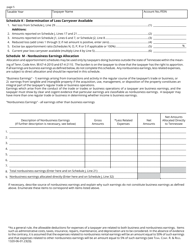

Please view the topics below for more information. ET-1 - Excise Tax Computation. More about the Tennessee Form FAE-170 This form is for.

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Form Fae 170 Franchise And Excise Tax Return Kit

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form Fae 170 Franchise And Excise Tax Return Kit

Fillable Online Tennessee Tennessee Department Of Revenue Franchise And Excise Tax Tennessee Fax Email Print Pdffiller

Tennessee Franchise Excise Tax Price Cpas

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

Get And Sign Tennessee Franchise And Excise Tax Form 2017 2022

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Franchise Excise Tax Exemptions Farming Or Personal Residence Youtube

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com